Content Navigation

1. From Tech Pioneer to Market Dominator: The Rise of DDR4

DDR4’s story began in 2008 with early conceptual designs, but it wasn’t until 2014 that it officially entered the market. Initially, high costs (3x pricier than DDR3) and compatibility issues limited its adoption to high-end servers and niche PC builds. The turning point came in 2015 with Intel’s Skylake processors and AMD’s Ryzen series, which brought DDR4 to mainstream consumers by resolving hardware compatibility and driving down prices through improved manufacturing scalability. By 2017, DDR4’s price gap with DDR3 narrowed to just 20%, cementing its dominance.

Technologically, DDR4 outshone DDR3 with:

- 20% lower power consumption (1.2V vs. DDR3’s 1.5V).

- Higher frequencies (starting at 2133MHz, overclockable beyond 4800MHz).

- Massive capacity (up to 64GB per module), crucial for data-heavy tasks like 4K video rendering, where DDR4 reduced Adobe Premiere Pro export times by 40%.

2. Gaming vs. Servers: DDR4’s Dual Reign

Gaming Performance

Post-2017, AAA titles like Cyberpunk 2077 and Assassin’s Creed Odyssey demanded higher bandwidth. DDR4-3200 delivered 15% higher FPS and 30% lower latency than DDR3-2136. Even after DDR5’s 2021 debut, DDR4 remained popular among gamers due to DDR5’s early high latency (CL40 vs. DDR4’s CL16). As of 2024, 58.2% of DIY builders still chose DDR4.

Server Market Dominance

In data centers, DDR4’s 128GB ECC modules and energy efficiency slashed annual power costs by millions of dollars for large-scale server farms. Its mature ecosystem allowed seamless upgrades without architectural overhauls. By 2025, 95% of global cloud servers relied on DDR4, with AWS offering DDR4-based “economy instances” that were 35% cheaper than DDR5 alternatives.

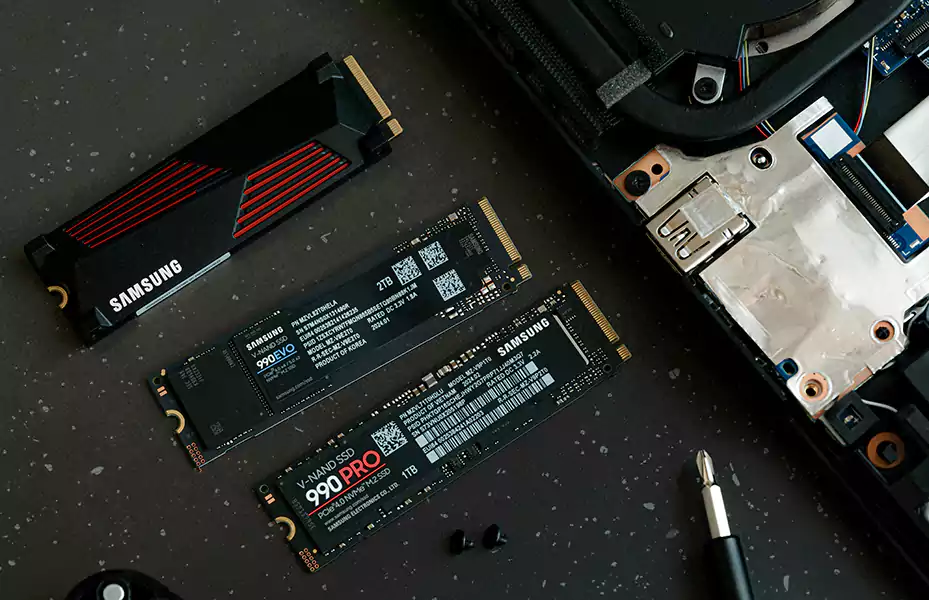

3. Supply Chain Shifts: Survival in the DDR5 Era

Starting in 2024, giants like Samsung and SK Hynix cut DDR4 production to 20% of capacity, prioritizing DDR5 and HBM. This created opportunities for Chinese manufacturers like CXMT (ChangXin Memory Technologies), whose 16nm DDR4 modules undercut Korean rivals by 18%. Despite a 6% drop in DDR4 chip prices in 2025, consumer-grade 16GB DDR4-3200 kits stabilized at $50-half the cost of DDR5 equivalents. This affordability made DDR4 the go-to choice for budget-conscious SMEs and schools.

4. Why DDR5 Can’t Kill DDR4 (Yet)

DDR5 faces three key hurdles:

- Costly upgrades: Adopting DDR5 requires new CPUs, motherboards, and sometimes PSUs, adding $300+ to system costs.

- Slow production growth: In 2025, DDR5 accounted for just 30% of global DRAM output, with premium chips reserved for AI servers.

- Backward compatibility: Intel’s 14th-gen CPUs still support DDR4, and AMD’s AM4 motherboards extend its lifespan.

DDR4’s “snowball effect” thrives in legacy systems, refurbished hardware, and industrial IoT devices, creating a 10-billion-unit ecosystem that’s hard to replace. As analyst MS Hwang noted, “DDR4 is the Windows 7 of PC hardware-everyone knows it’ll retire, but someone’s always finding a reason to keep using it.”

5. The Philosophy of ‘Good Enough’

While DDR5 pushes boundaries with lab-tested 11,000MHz speeds, DDR4 remains practical for most users. It runs GTA 6 smoothly and handles daily tasks effortlessly. This clash between ”cutting-edge specs” and ”real-world adequacy” defines DDR4’s enduring appeal. In an era of relentless tech upgrades, DDR4 proves that sometimes, “good enough” is all you need.